What is the look-to-book ratio?

The look-to-book or look to book ratio is exactly what it says it is: a comparison of the number of people who visit a website with the number who make a booking. This ratio, if used with other important key performance indicators, can help travel companies understand how effective their websites are as sales tools and how good they are at securing bookings.

Wouldn’t it be nice if your look-to-book ratio were 1:1 so that every single person who searches on your website finishes up their visit by booking a holiday with you? A nice dream to have, but a look-to-book ratio of 1:1 is an unrealistic goal.

What does your look-to-book ratio tell you about your business?

Essentially your look-to-book ratio is a useful metric that indicates how effective your website is as a sales tool.

However, you will need to use other metrics to get a more complete picture of your performance. For example, revenue per search (total revenue divided by number of searches during a specific timeframe) is arguably a more valuable metric because it takes into consideration a travel agent’s actual selling power.

Two travel agents could have very similar look-to-book ratios, but one may be generating much higher revenues.

Before we get to the mechanics of how your website is performing, we need to consider how effective your business model is in the first place.

There are millions of travel destinations and a relatively small number of very large travel agencies and OTAs which are in the business of selling every facet of travel to every consumer across the world. So unless you are confident of your ability to compete with the likes of Booking.com and Expedia it really does not make sense for you to be a jack-of-all-trades.

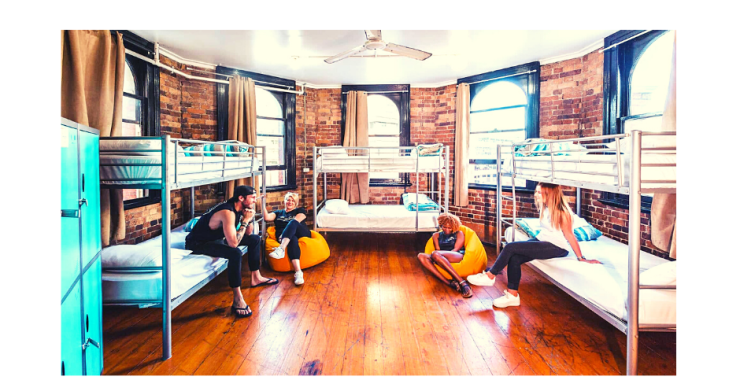

A much better idea would be to specialize in one particular niche e.g. hiking vacations in the Scottish Highlands or MICE in Portugal. Being a specialist allows you to give more in-depth information about your destination or product that customers will not find with the major travel aggregators.

Obviously, the further advantage you have as a travel agent or tour operator is that you are selling complete dynamic packaging. The client is buying your expertise and ability to do the leg-work instead of having to make multiple searches and reservations herself.

Generating higher revenues for OTA without increasing their sales efforts

For example, over $2b worth of reservations and generated more than $100m of extra profit for our customers. In fact, the trend in the 21st century has been for look-to-book ratios to get bigger and bigger. Around 15 years ago, airline systems had a 10:1 ratio of searches to actual bookings. More recently, according to Amadeus, the look-to-book ratios for many airline systems have climbed to 1,000:1. Why?

Consumer behavior’s in general has had a major impact on look-to-book ratios. In the past, travelers tended to have just one destination and a specific time in mind when they were searching for a ticket.

Compare that to the last ten years in which Millennials have come of age. This new generation of young adults now has spending power but different spending habits. They look at more products, tend to be more flexible about their schedules, and may be searching for ideas and prices for more than one location. If we also add in the increased complexity of dynamic travel pricing, then this creates a tendency to increase look-to-book ratios.

But hang on a minute. Sure, Millennials may like to do their research and surf a few sites to find a bargain. But none of us, whatever our age, looks at travel websites 1,000 times before we make a purchase. So how have average look-to-book ratios ballooned to such heights?

There are two possible reasons and they come from searches that are not necessarily made with the intention of buying. Firstly, machine-generated searches that collect pricing data for analysis are bumping up the ratio. This automated approach shows us the application of big data in the travel industry. Secondly, searches from intermediaries, such as bed banks, wholesalers and aggregators are also increasing the ratio.

How do you improve your look-to-book ratio?

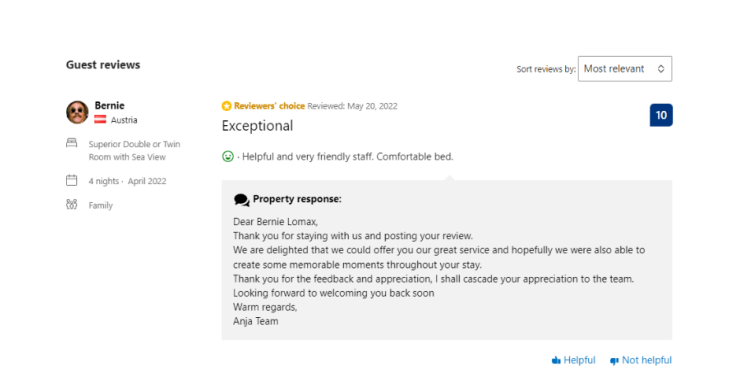

Once you are demonstrating your particular expertise and you have done everything possible to optimize your site in terms of metasearch rankings, then your look-to-book ratio should decrease.

You should also conduct an audit of your website to monitor visitor experience and take steps to increase conversions. Take a forensic approach to monitoring which of your pages are most popular and why, how long visitors are spending on each page, and how your sales funnels are performing.

What will happen to look-to-book ratios in the future?

If we take a look at the hotel booking industry alone, it is enormous. Globally, 6.3 billion hotel bookings are made every year, and in 2018 these accounted for $600bn in revenue. It was one of the first mass-sectors to use the internet but one which has barely moved on since then in terms of technological advances.

One development that could help to bring down overall look-to-book ratios would be freeing up the availability of hotel data so that it is not concentrated in the hands of a relatively small number of hotel chains, travel agents and OTAs.

Thanks to a new generation of APIs (application programming interfaces), the technological capability already exists to give any business access to global hotel data.

This is already happening in a limited way – think of how airlines encourage clients to book accommodation and car rentals while on their sites – but we could see a future where hotel and airline data is made widely available to companies whose core business is not travel.

A book publisher could directly sell trips associated with their latest best-seller, or a wine merchant could sell vineyard tours.

Across the world, hoteliers dislike how much inventory and commission (25-30%) they give to the likes of Booking.com and Expedia.

Instead, thanks to plugging into a new generation API, almost any business that wanted to would have access to hotel data and be able to sell room nights on behalf of hotels for a charge much closer to a typical credit card fee of 3%.

It is hard to predict how such a development would affect look-to-book ratios but we hope this article helped you understand how to use it to increase the profit margin in tourism industry. In the end, any business that succeeds in giving customers what they want will see its look-to-book ratios go down and revenue per search increase.